Comic Book Investment Guide

Superhero comics being sold for big money is one of the classic quirky headlines of the internet age. We all know how popular the characters are, but it always shocks an outsider to learn what collectors are paying for a mint-condition Batman comic that was once sold for a dime apiece!

But to those engrossed in the world of comics trading since the first Comic Book Price Guide was published in 1970, the parade of six- and seven-figure sales is far from surprising. The steady climb of prices for historic comic book issues has been carefully documented year after year, compounded by the scarcity of older comics and surging mainstream interest in superheroes. Specialist data hub GPAnalysis marks total revenues from comic book trading at $1,048,922,897 USD since 2001.

Mythic Markets has helped to roll out the red carpet for a new audience of collectors and speculators. Our platform joins an ecosystem of auction houses, trading forums and price authorities which have streamlined and clarified the process of buying and selling comics. With these combined services and data at investors’ fingertips, fans and newcomers alike can now consider vintage comics alongside other asset classes when diversifying their portfolio.

What’s the difference between “collecting” and “investing”? The return.

Vincent Zurzolo of Metropolis Collectibles holding a CGC 9.0 copy of Action Comics #1 valued at more than $3.2 million (USD).

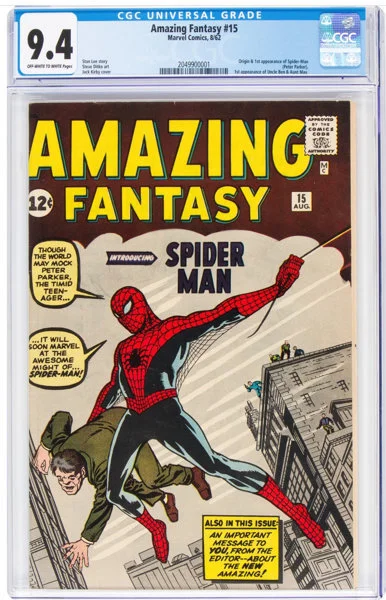

The idea of owning a century-old piece of pop culture history can be exciting to many people. But when we’re looking at Amazing Fantasy #15 or the first ever Fantastic Four issue as an investment, then that beautiful piece of history has to justify its asking price with the potential for growth. And it’s true, the largest caveat to investing in collectibles is that not every asset will grow by an average of 422085% (25.62% per year) (the napkin math for 1938’s Action Comics #1). There are a great many issues of comic books out there, and only a fraction has garnered the historical interest which drives them to investment-level valuations.

The comic book market is extremely well documented, having established common, data-based standards for the grading and valuation of comics a generation ago. Price trends are transparent, not only for the well-known “blue-chip” comics like Action Comics #1, but for any issue you care to look up! In addition to raw sales and scarcity data, sites like GoCollect and GPAnalysis track the overall growth for key sub-classes within comics.

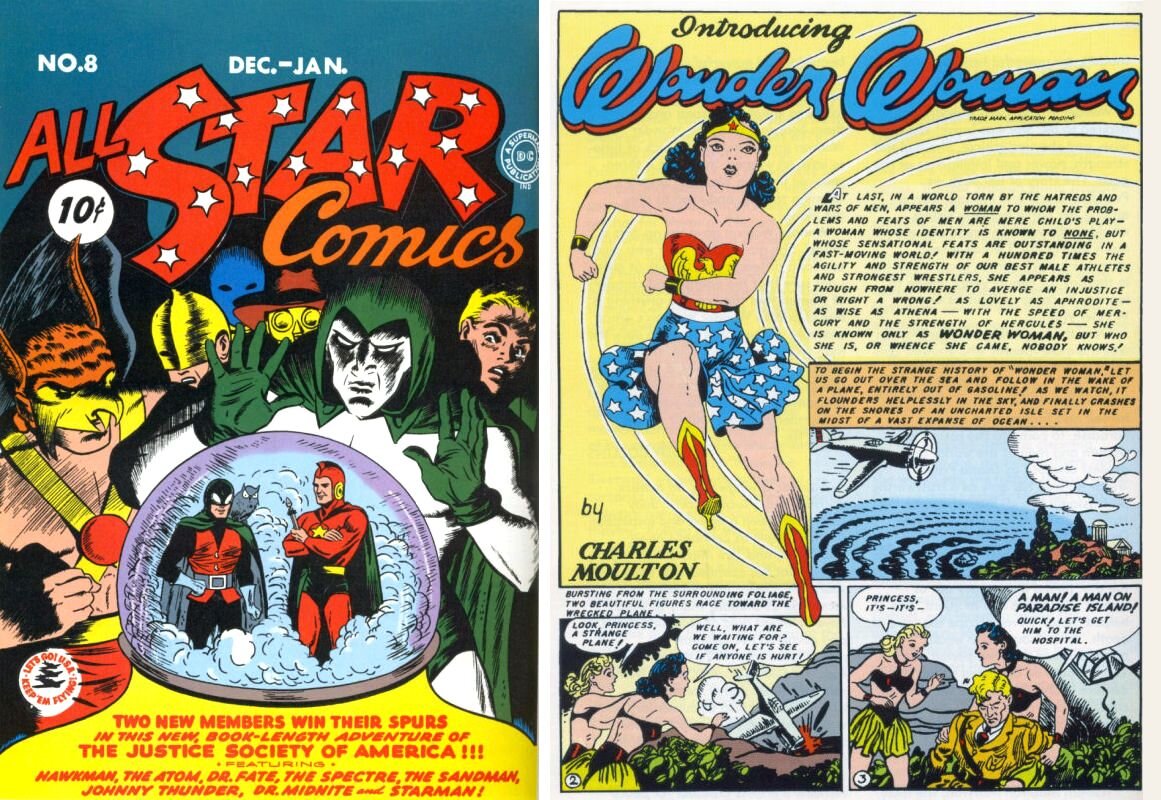

This sales data is the foundation of the modern collecting community. Experts on the aforementioned sites and independent blogs take on the role of comic book day-traders, relishing in the chase of micro-trends affecting cheaper issues. But for those blue chip comics, which often feature the first depiction of cultural giants like Spider-Man or Wonder Woman, the trend is simply decades of documented growth. Whatever your preferences for risk vs. return, the data can guide you to comics which fit that profile.

Take Amazing Fantasy #15 - an innocuous sci-fi short stories compilation which debuted Stan Lee and Steve Ditko’s newest creation: Spider-Man. In the decade after Sam Raimi first reintroduced Peter Parker to the broader cultural zeitgeist with 2002’s Spider-Man, the average sale price of high-grade AF#15 copies (above 9.0) rose by 80%, according to top analytics company GoCollect. For those looking to invest less than $100K, the average price of (far more common) 6.0 grade copies rose by 50% to above $16K, with demand trickling down to the roughest and most damaged 0.5 graded copies, which shot up 144.3% to reach $1500 by 2010.

Prices continued to rise steadily through the 2010’s, along with the volume of books on the market - but it was at the top end that showed the most decisive growth. Figures obtained from GPAnalysis.com show that in 2005, a copy of AF#15 from the famously well-preserved “White Mountain” collection fetched a record $126,500. The 2020 price for the same comic would be $795,000 - and that’s not even close to the new record sale price!

Amazing Fantasy #15 - Spider-Man swings into action!

For other popular issues, especially those from the older and more scarce Golden Age, the long-term trends are just as impressive: 800% growth for Wonder Woman’s first comic (All-Star Comics #8) since 2000, while Batman’s debut in Detective Comics #27 has seen 200% growth for high-grade copies and 600% growth for damaged copies over that same period.

All-Star Comics #8 - Wonder Woman joins the fight for justice

The strategic value of adding comics to your portfolio

While investing in comics may sound like an unorthodox strategy, this sort of alternative asset has a vital role to play in modern portfolio theory. Career investors looking to minimize their risk are best served by a diversified portfolio featuring multiple asset classes - or as most of us say, you don’t put your eggs in one basket.

If any asset class is potentially insulated against stock market forces, comic books and other collectibles have a strong argument. The value of a mint-graded Amazing Fantasy #15 - which introduced 1960’s teenagers to their friendly neighborhood Spider-Man - is not derived from Marvel’s stock price. No, its million-dollar price tag comes from Spidey’s cultural and historical significance, which may not be diminished by the whims of the market!

This self-contained value, dependent on society’s reverence and sentimentality, positions comics similarly to how art functions as a diversification strategy. Art investment has an even longer history than comics trading, and data shows that art markets have expanded even during major recessions. A market study published in The Review of Financial Studies (Vol.29, No.4) found that the correlation between art and traditional asset classes was “less than 0.3 for almost all art indices, and statistically no different from zero except for the correlation with real estate.”

While we don’t yet have the same formal studies on the comic book market, there are enough similarities with the art trade to support a commonsense argument for comics investment as a diversification strategy. And even amidst the dramatic events of 2020, that assumption is holding true - GPA figures show the total value of comics sold each month has risen against historic averages. We cannot say with certainty that a comic book portfolio would be recession-proof, but the numbers show an increasing number of investors are willing to try it.

How to find your comic book origin story?

There are as many ways to begin investing in comic books as there are comics. Some collectors start by seeking out the most prominent issues of their favorite character, or eye-catching covers which will work for a display piece. The personality and expression possible in a comics portfolio is part of what makes them so fun and exciting as an asset class. Even from a purely financial perspective you can choose between working a margin on bulk trades of Bronze Age comics, where the individual risks are low, or using your awareness of popular trends to speculate on new comics that might take off.

All-Star Comics #8 on Mythic Markets - the first appearance of Wonder Woman!

Traditionally though, the truly legendary issues which draw those headline-making sale prices are out of reach for all but the most affluent buyers. Even if you had a spare million or two to invest, the risk of committing that much to an illiquid asset like a single comic book wouldn’t be recommended by your financial advisor. But Mythic Markets has made it our mission to change this reality. Through our platform, you can invest in historic comic books (and other assets) just as you would any security: at your preferred price of entry, and with the opportunity to sell again on our marketplace with the touch of a button. Our Classic Comics Collection features many of the “blue chip” issues mentioned here, including the debuts of Spider-Man, Wonder Woman and the Fantastic Four - and it can be your point of origin for comics investment too.

Legal Disclaimer

The securities offered by Mythic Markets are highly speculative and investing in them involves significant risks, including possible loss of an entire investment. An investment could be illiquid for an indefinite period of time. No public market currently exists for the securities.

Forward-Looking Statements

The offering materials may contain forward-looking statements and information relating to, among other things, Mythic Markets. Its business plan and strategy, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company's management. When used in the offering materials and in our web site materials, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to constitute forward-looking statements. These statements reflect management's current views with respect to future events and are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements.

Financial Projections Disclaimer

Any financial projections, forecasts, or forward-looking statements available on this website are based on assumptions or expectations which are believed by management to be fair and reasonable at the time they were prepared. All statements other than statements of historical fact are, or may be deemed to be, forward looking statements. The financial projections, forecasts or forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and contingencies.