Video Game Investment Guide

Video games are the defining medium of our lifetime.

Just as the last century charted the growth of cinema, so we are seeing the rapid evolution of games as an artform and worldwide cultural touchstone. As early classics like Super Mario Bros. and Space Invaders grow in price and stature, they seem poised to take over from prestige comic books and trading cards as the next wave of investment-grade collectibles.

The ever-increasing importance of the games industry goes without saying to those familiar with millennials and younger demographics. In revenue, stream viewership, advertising and development budgets and global brand recognition, games dominate even the biggest Hollywood blockbusters. And with the advent of mobile gaming and virtual reality, it seems that gaming will only become more central to our lives going forward.

College courses in game design study landmark games from the ‘80s and ‘90s to better understand the principles of their success - and so continue to raise their standing as modern classics. That reverence is reflected in the price tag of vintage game discs and cartridges, which are now rare and sought-after collectibles.

Mythic Markets is a specialist marketplace which already caters to an audience of dedicated collectors and bold investors with offerings of blue-chip collectible assets. Our platform streamlines the process of trading these rare, delicate items by offering them to investors as tangible shares regulated by the Securities and Exchange Commission. That’s right, you can buy shares in Golden Age comics or mint Reserved List Magic: the Gathering sets and - starting Spring 2021 - trade them on our online marketplace! For the growing audience of traders aiming to profit from this asset class instead of hoarding a collection, the Mythic Markets platform offers maximum access and flexibility.

Ride the alt-investment diversification wave and reduce your risk

Collectibles in general have already gone from strength to strength over the past decade. Ever since the first tremors of the global financial crisis in the late 2000s, auction houses have measured a growing interest in alternative assets - those with value not closely tied to the fortunes of Wall Street. High-profile sports cards and comic books have joined fine art in the portfolios of private funds, which aim to buffer themselves against another market shock; and thanks to the popular appeal of these collectibles, droves of individual investors are following suit.

This upwards trend was thrown into overdrive by the 2020 coronavirus pandemic. Uncertainty on the stock market left investors of all stripes searching for a safe haven, and thanks to widely publicized record sales for Michael Jordan sneakers and first edition Pokemon cards, collectibles emerged as a leading choice.

Since their value depends on sentimental and cultural significance, collectibles have a strong evergreen appeal to their fans; and as each generation of fans matures into a stronger market force, the weight of that interest can translate into appreciation. The value of Action Comics #1 has averaged steady 25% growth year-on-year since its printing in 1938. The earliest collector’s guides to Magic: The Gathering, from the game’s debut year in 1994, set the market value of a Black Lotus at a cool $30. By 2021, the auction of a perfect Gem Mint, Alpha-printing specimen set a new record price for that card: $511,000.

A 1994 price guide for Magic’s original set scanned by a veteran collector. While these prices cover the slightly less valuable Beta printings, they have all still risen dramatically over the decades.

Best of all, the mass-produced nature of these collectibles makes it easy to establish a consensus on price. Assuming good condition, every Super Mario Bros. cartridge or 1st edition foil Charizard on the market holds equal value. With price manipulation a constant concern in more subjective fields like fine art, investors may find video games and other graded collectibles a refreshingly straightforward alternative.

Big names in private capital seem to agree: billionaire investor Steven Cohen and Dan Sundheim’s D1 Capital Partners recently sunk $700 million into grading and services company Collectors Universe - betting on a bright future for the collectibles market.

The investment prospects of classic games are powering up fast

Mythic Markets doesn’t just see a bright future for our classic gaming offerings - we’re seeing a bright present, right now. The pandemic-enhanced rush on alternative investments put a match to the fuse of this asset class, which always had the popular appeal and thorough documentation to justify serious price tags.

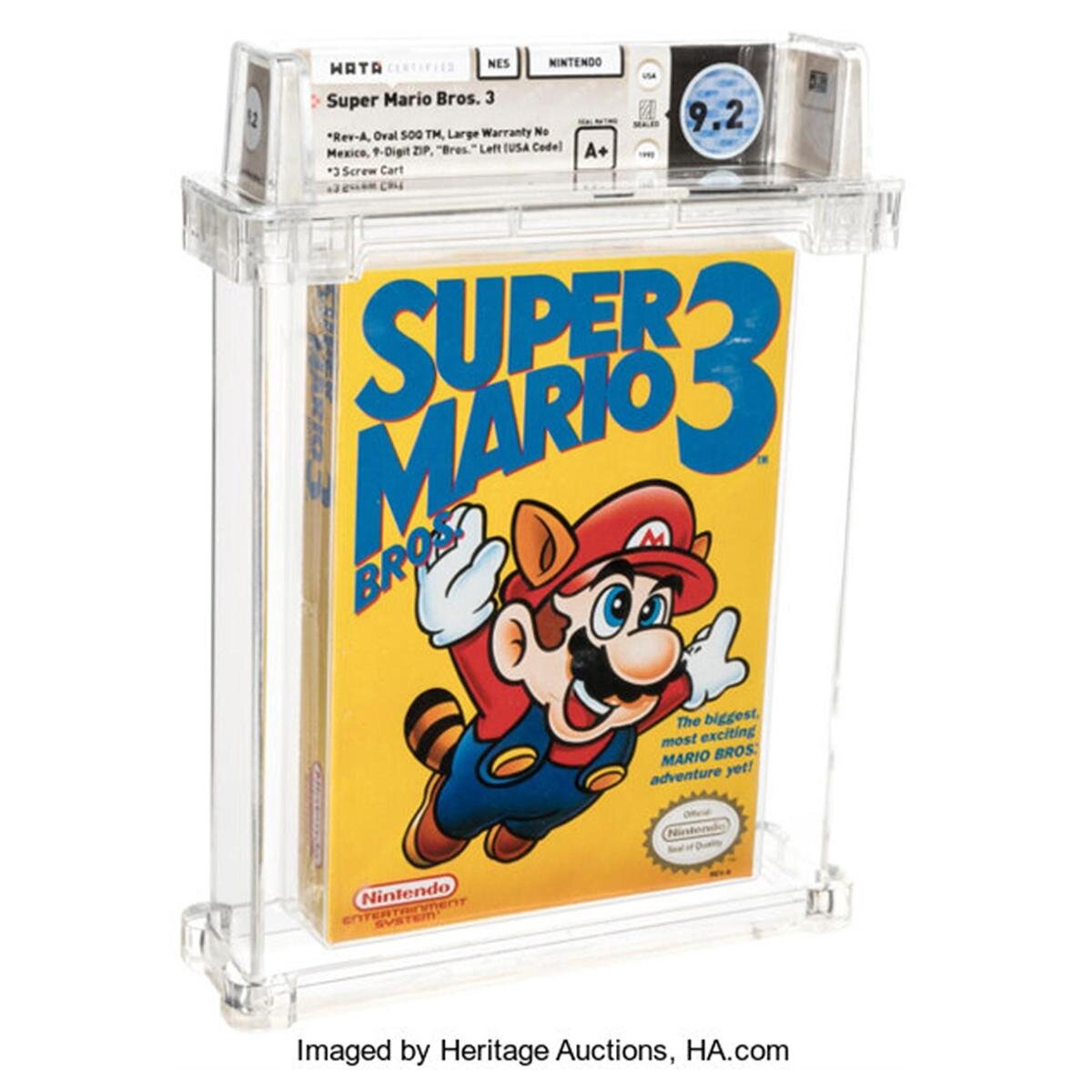

Super Mario Bros. 3 sold for $156K in November 2020.

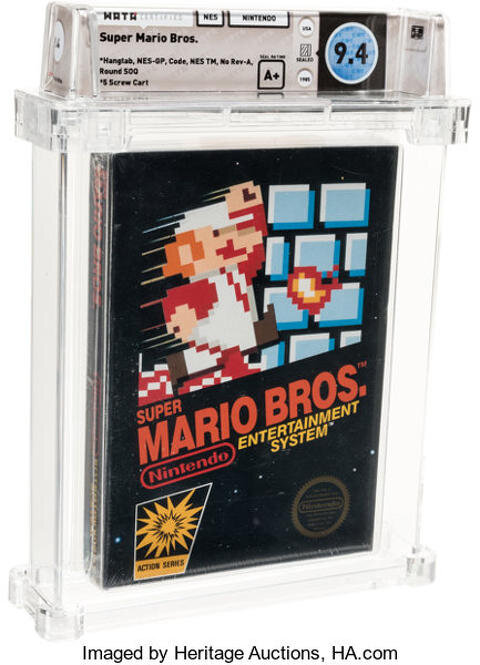

Now the record for “highest price paid for a video game at auction” has been broken twice in the past six months! And where previous record sales often concerned one-off curiosity pieces or forgotten prototypes, these historic lots (and others) concerned retail release copies of well-known games - Super Mario Bros. (sold July 2020 for $114K USD) and Super Mario Bros. 3 (sold November 2020 for $156K).

Looking closely at the ecosystem supporting these sales you can see why investors are finally ready to pay six-figure sums for a humble NES game. Historically, the key to unlocking meteoric price growth for other classes of collectibles has been the establishment of specialist authorities and infrastructure within that niche. Professional grading, price guides and auction services consolidate the excitement and knowledge of the global collector community, and lower barriers to entry for cashed-up new investors.

Once they gain the trust of collectors, these organizations can push for acceptance of standardized classification, grading and pricing for classic video games. Centralizing important trades on a handful of common platforms accelerates this process. With direct competition between sellers of similar assets and plenty of historical trading data available, investing in games becomes much more intuitive to new investors - even ones who wouldn’t know Mario from Sonic! This is the ecosystem Cohen and Sundheim are making a play to control: one which enables the growth of the market it profits from.

But they will have to sprint to catch up. The current wave of record sales was driven by a working alliance of service providers, who together have assembled an unmatched professional pipeline for bringing big name games to auction. Both of the record prices mentioned above were notched at sales from Heritage Auctions, a well-established auction house which now bills itself as “the world’s largest collectibles auctioneer”. Their choice to expand and promote their classic game sales alongside comics and other collectibles has doubtless brought in new interest and new money to those lots.

Bullish services startup makes the grade

Pokemon: Red Version fetched $84K at auction.

Even more vital to significant growth is a single, universally accepted grading standard, which seems to have emerged in the form of young startup WATA. Though it was only founded in 2018, WATA bears an excellent pedigree among its executives, prominent games collectors and founders from dominant comics grader CGA. They offer a complete set of polished middleman services, from their proprietary “WATA Scale” grading to secure “slab” cases standardized for the dimensions of video game boxes.

The benefits of credible, analytical grading are visible in those record-setting Heritage lots. The massive $156k SMB3 sale came just 4 months after another near-mint copy went at Heritage for a mere $38,400. The difference between the two games? WATA scored the record-setter a single grade higher, 9.2 to 9.0.

In the same huge Heritage session, front-running Pokemon title Pokemon: Red Version fetched $84K, 400% of its original pre-sale estimate! The bidding bonanza was arguably fueled by this copy’s own WATA grade: an elusive 9.8 A++. For comparison, an 8.0 copy was sold in June for $4,400. The exact impact of these grades may be hard to measure - but not their overall success in driving up prices.

Mythic Markets helps you get into - and out of - the most valuable video game investments

Mythic Markets is another essential piece in this game investment service stack. We offer significant advantages to investors keen to grab a piece of the recent surge in collectibles investment - including Ease, Flexibility, and Access.

Our proprietary marketplace lets you buy into new collectible assets with Ease. There’s no need to wait on the perfect auction to come up with your favorite game, or trawl through anonymous sellers online. You can buy shares in our offerings at the press of a button whenever you want! If you’re venturing outside your comfort zone, you can read about the historical background and providence of each asset on our marketplace. You’ll also find links to the asset’s Offering Circular and other legal information you’ll need before making a decision to invest.

Even if you don’t consider yourself to need that kind of help when buying games, Flexibility is king when you need to negotiate the ups and downs of an emerging market. And there are few models as flexible as fractional investment. Without the hassle of transferring entire physical copies, starting Spring 2021 you’ll be able to trade shares with other investors at the push of a button. And of course, fractional ownership lets you make incremental trades instead of dealing in whole units - naturally increasing your liquidity and flexibility.

Access is the other big advantage investors can reap through fractional investment - the ability to share in the fortunes of blue-chip assets. As prices of games and other collectibles rise, the most widely recognized “grail items” snowball out of the reach of individual investors. While fractional investment leaves you without a physical item to display, it enables you to own your personal dream game at your own preferred price point, and still enjoy the same prospects and returns as you would with traditional, full ownership.

The Mythic Markets classic game collection is releasing one big name after another to our investors. Sign up for free today and make sure you get a stake in the next one.

Now available on Mythic Markets

Metroid

Introducing Nintendo’s revolutionary debut of gaming’s first heroine. Invest on Mythic Markets at $25 per share.

Legal Disclaimer

The securities offered by Mythic Markets are highly speculative and investing in them involves significant risks, including possible loss of an entire investment. An investment could be illiquid for an indefinite period of time. No public market currently exists for the securities. All securities transactions are executed through Dalmore Group LLC, a registered broker dealer, member of FINRA (www.finra.org) and member of SIPC (www.sipc.org).

Forward-Looking Statements

The offering materials may contain forward-looking statements and information relating to, among other things, Mythic Markets. Its business plan and strategy, and its industry. These forward-looking statements are based on the beliefs of, assumptions made by, and information currently available to the company's management. When used in the offering materials and in our web site materials, the words "estimate," "project," "believe," "anticipate," "intend," "expect" and similar expressions are intended to constitute forward-looking statements. These statements reflect management's current views with respect to future events and are subject to risks and uncertainties. Actual results may differ materially from those contained in the forward-looking statements. Investors are cautioned not to place undue reliance on these forward-looking statements.

Financial Projections Disclaimer

Any financial projections, forecasts, or forward-looking statements available on this website are based on assumptions or expectations which are believed by management to be fair and reasonable at the time they were prepared. All statements other than statements of historical fact are, or may be deemed to be, forward looking statements. The financial projections, forecasts or forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and contingencies.